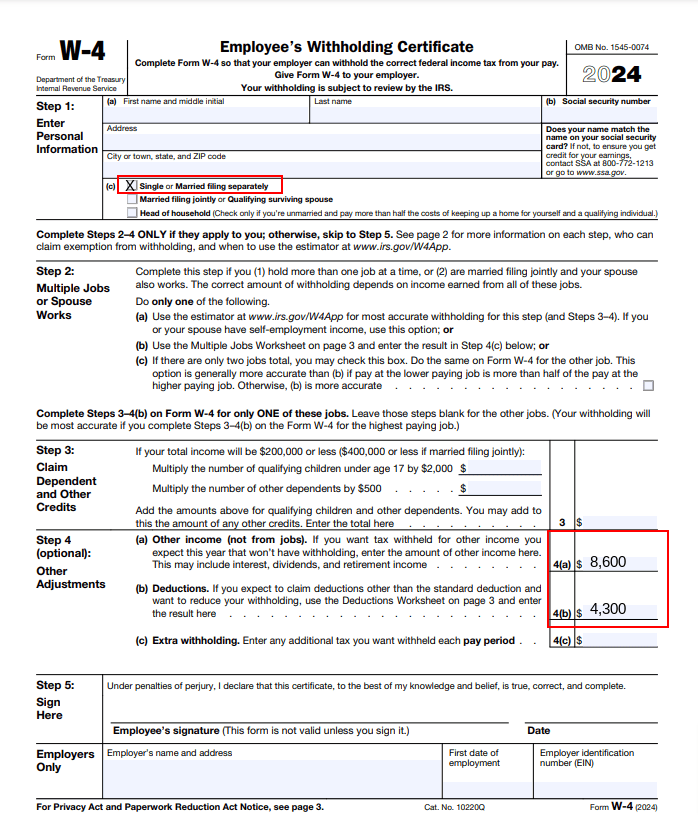

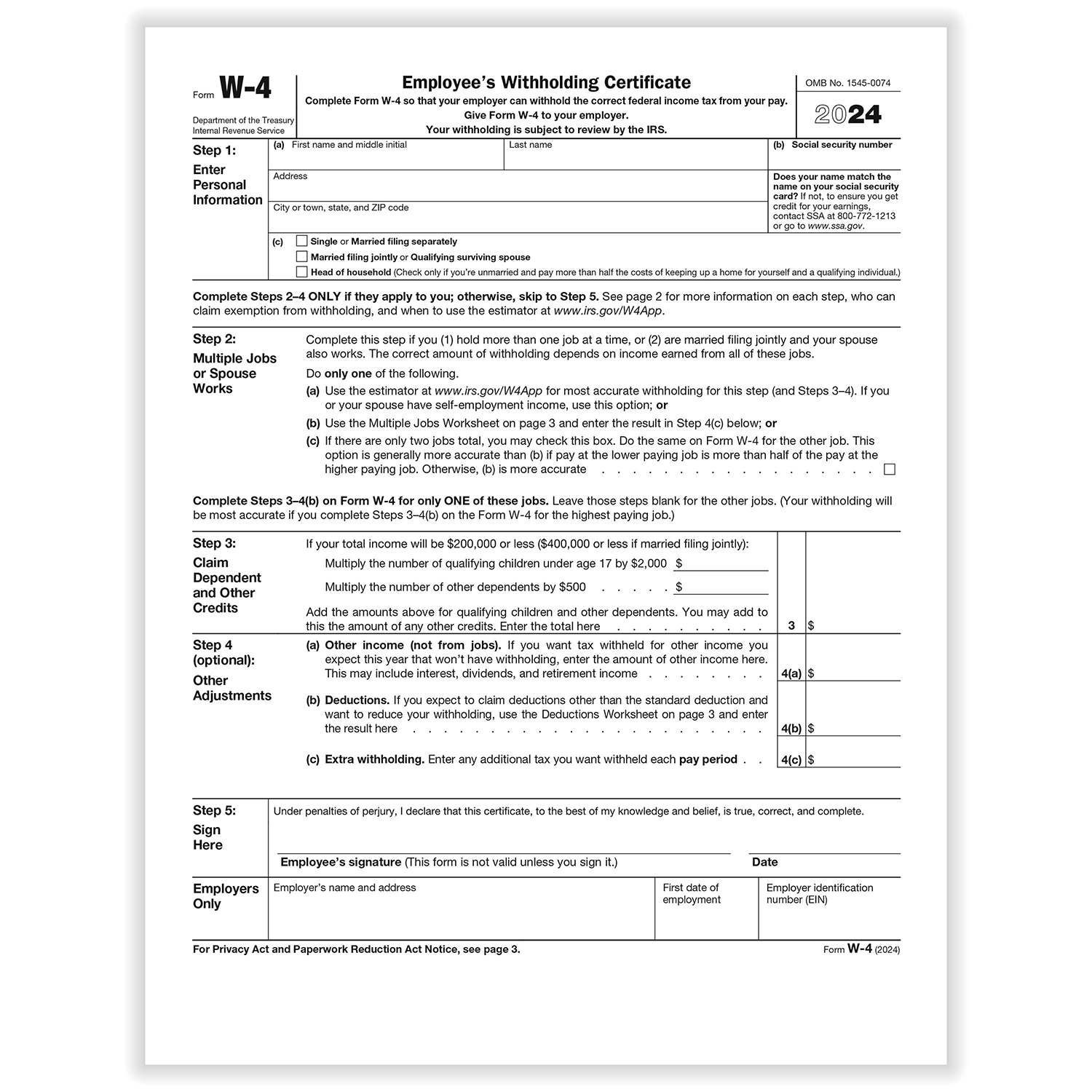

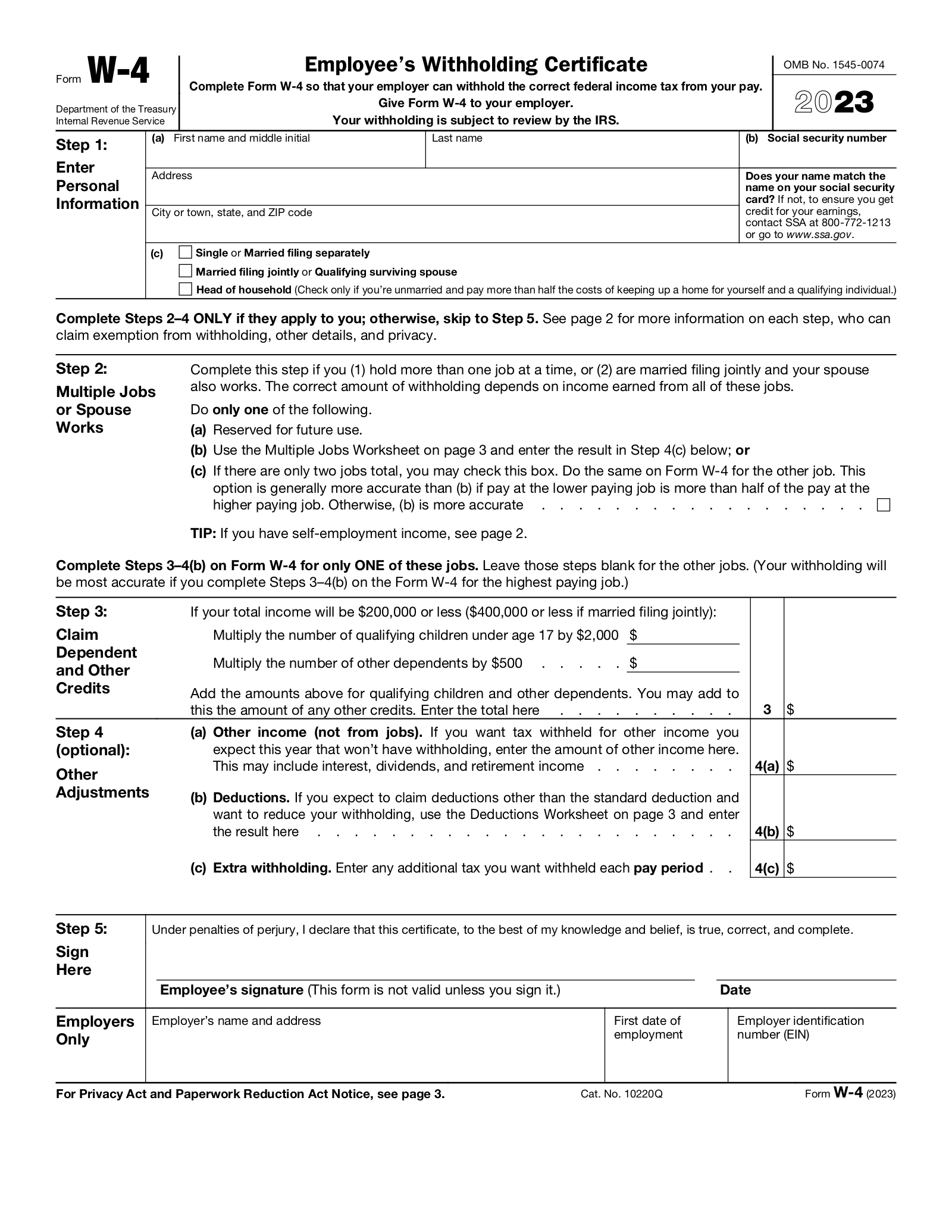

New W-4 Forms For 2024 Schedule – A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer an updated version of Form W-4 for 2024, which can be used to adjust withholdings on . As we enter the 2024 proxy season resulted in a restatement that triggered a clawback analysis; and new Item 402(w) of Regulation S-K requiring certain disclosures in Forms 10-K and proxy .

New W-4 Forms For 2024 Schedule

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com2024 Form W 4P

Source : www.irs.gov2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.com2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.comFree IRS Form W4 (2024) PDF – eForms

Source : eforms.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comW4 Form 2024 | Filling out the W 4 Tax Form | Money Instructor

Source : m.youtube.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comNew W-4 Forms For 2024 Schedule Employee’s Withholding Certificate: Please refer to the Management Tools for instructions for managing hourly employee payroll. Federal income tax is calculated based on IRS tax tables and selections made on Form W-4. State and local . A New Jersey but schedule an appointment as early as possible to ensure your taxes get filed on time. “Anytime a person’s tax returns involve more than W-2 and 1099-INT forms, it is .

]]>